Kolkata: Industry experts have termed the Union Budget 2022-23 as balanced and progressive. Let’s take a look at what Industry experts have to say about the budget:

Umesh Revankar, VC & MD at Shriram Transport Finance: The union budget 2022 is a bold and growth-oriented budget which will result into a multiplier effect on the economy and benefit the Aam Aadmi, despite no direct benefit transfers. We believe the FM has presented an investment led budget and this will propel sectors like cement, steel and construction which will lead to increased movement of goods, boost bulk transportation movement and help in the revival of the transport industry. The government widening the ECLGS scheme & revamping CGTMSE (Credit Guarantee Trust for Micro and Small Enterprises) are steps taken to accelerate growth and reduce stress particularly in the MSME segment. Housing project allocation of Rs 48000 crore is likely to boost growth momentum for the building materials sectors and real estate activities in general. We believe the budget is a very forward looking one with emphasis on digital economy and reducing carbon footprint, which will benefit digital lending and lead to environment friendly policies going ahead for the vehicle sector. Ease of doing business has taken centre stage as the Government has committed to a long-term growth of over 8% for the next 3 years. India’s economy is now well placed and we are optimistic on credit uptake in the economy.

Mr. Vijay Chandok, MD & CEO – ICICI Securities: The Union Budget 2022-23 is a Budget with a vision to transform India in the medium term. The budget has adopted new economic growth template for “Amrit Kaal” (run up to India@100) by promoting capital expenditure led economic growth. Outlay of Capital expenditure of Rs 7.5 lakh crore, up ~35% YoY (and at 2.9% of GDP) along with expanding the scope of private capex through PLI for new age segments is expected to deliver inclusive growth, job creation and welfare for all. The Budget also seem to be presented in the backdrop of likely pandemic aftereffect which is reflective in the relatively conservative estimation of growth (merely ~11% nominal GDP in FY23) and receipts. Thus, there is a likelihood of lower than projected fiscal deficit. With growth oriented focus intact in the Budget, we expect economic and capital market buoyancy to remain.

V. Balasubramaniam, MD & CEO, India INX: India’s focus has been on sustainable growth and development; the Budget announcement to enable green bonds to be issued in public sector projects will give further impetus to green finance and pave the way towards a greener and sustainable long term economic growth. Additionally, the announcement of the International arbitration centre to be set up in IFSC, is a key addition as it provides a proper structure to resolve conflicts. Announcement of mediation centre and fin tech education centre at GIFT IFSC is a great step and will go a long way in establishing the IFSC as a ‘Global Financial Hub’. Additional tax exemptions on ODIs, shipping royalties and exempting NRIs income from IFSC continues to keep IFSC competitive from tax perspective.

Kavitha Subramanian, Co-Founder, Upstox: The Hon’ble Finance Minister has presented a digital-first Budget that focuses on quick, holistic, and inclusive economic growth. The focus on start-ups and fintech in this year’s Budget is a fantastic step that will help these sectors grow further. The introduction of 5G and the spread of optical fiber to villages would provide a boost to the Fintech industry. It encourages digital investment platforms like ours to expand their services, resulting in an increase in retail activity in Tier 2-Tier 3 cities and towns. The Central Bank Digital Money (CBDC) will help to enhance the digital economy by making currency management more efficient and less expensive. The capping of surcharge at 15% on Long-Term Capital Gains (LTCG) tax for all listed and unlisted corporations responds to a long-standing demand for new-age businesses.

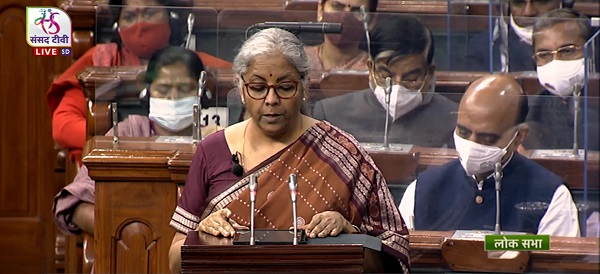

Anirudha Taparia, Joint CEO, IIFL Wealth: My congratulations to FM Nirmala Sitharaman and the government for delivering a well-rounded and holistic budget that tactfully manages to strike a balance between growth and fiscal profligacy while marching towards achieving the overall goal of becoming an Atmanirbhar Bharat. The overall increase of 35.4% in capital expenditure to Rs. 7.5 lakh crore coupled with the intention of crowding private investment through higher public spending is likely to drive the fledgling recovery that we are currently witnessing. Further, measures to give an impetus to MSMEs and infrastructure spending are likely to have a multiplier effect on the economy, simultaneously boosting employment, production, and consumption. Today, as we stand in the aftermath of the pandemic, what we need are the right booster shots to get the growth flywheel moving while concentrating on human capital augmentation and adequate social sector and healthcare spending. The Union Budget has delivered on all these fronts.