Mumbai/Kolkata: Reliance Industries Limited and Jio Platforms announced that global alternative asset firm TPG will invest Rs.4,546.80 crore in Jio Platforms at an equity value of Rs.4.91 lakh crore and an enterprise value of Rs.5.16 lakh crore.

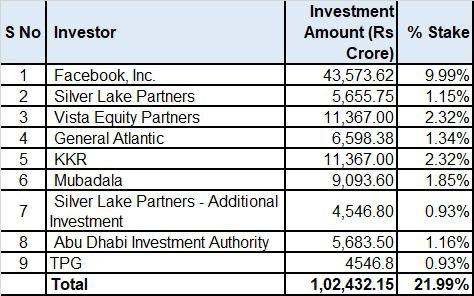

The investment will translate into a 0.93% equity stake in Jio Platforms on a fully diluted basis for TPG. With this investment, Jio Platforms has raised Rs.102,432.45 crore from leading global technology investors including Facebook, Silver Lake, Vista Equity Partners, General Atlantic, KKR, Mubadala, ADIA, and TPG since April 22, 2020.

Jio Platforms, a wholly-owned subsidiary of Reliance Industries, is a next-generation technology platform focused on providing high-quality and affordable digital services across India, with more than 388 million subscribers.

Jio Platforms’ vision is to enable a Digital India for 1.3 billion people and businesses across the country, including small merchants, micro-businesses and farmers so that all of them can enjoy the fruits of inclusive growth.

Mukesh Ambani, Chairman and Managing Director of Reliance Industries, said, “I am happy to welcome TPG as valued investors in our continued efforts towards digitally empowering the lives of Indians through the creation of a digital ecosystem. We have been impressed by TPG’s track record of investing in global technology businesses which serve hundreds of millions of consumers and small businesses, making the societies we live in better.”

TPG is a leading global alternative asset firm founded in 1992 with more than $79 billion of assets under management across a wide range of asset classes, including private equity, growth equity, real estate and public equity. Over TPG’s more than 25-year history, the firm has built an ecosystem made up of hundreds of portfolio companies and a value-added network of professionals, executives, and advisors around the world. Its investments in global technology companies include Airbnb, Uber, and Spotify, among others.

Jim Coulter, Co-CEO, TPG, said, “We are excited to partner Reliance to invest in Jio. As an investor in growth, change, and innovation for over 25 years and with a longstanding presence in India, we are excited to play an early role in Jio’s journey as they continue to transform and advance India’s digital economy. Jio is a disruptive industry leader that is empowering small businesses and consumers across India by providing them with critical, high-quality digital services. The company is bringing unmatched potential and execution capabilities to the market, setting the tone for all technology companies to come.”

TPG is making the investment from its TPG Capital Asia, TPG Growth, and TPG Tech Adjacencies (TTAD) funds.

The transaction is subject to customary conditions precedent.

Morgan Stanley acted as financial advisor to Reliance Industries and AZB & Partners and Davis Polk & Wardwell acted as legal counsels. Shardul Amarchand Mangaldas & Co. acted as legal counsel for TPG.